Case Study: MoneyWise

Created a financial education app to give users more control over their money because everyone deserves to feel financially secure and free.

Client

Brainstation

Roles

Tools

UX Research/ UI Designer

Figma, OtterAi

Timeline

10 Weeks

Platform

IOS

Welcome to MoneyWise, where we help you manage your money better. We know handling finances can be tough, so we've made it easy for everyone. With MoneyWise, you get a smart and friendly tool to take charge of your money.

As we navigate our way through the complexity of today’s economy it becomes increasingly evident that millennials and gen z have difficulties understanding and successfully managing their finances.

identifying the Problem

Data from surveys shows that in the US, only 24% of Millennials demonstrate basic financial literacy. Additionally, Gen Z has the lowest level of financial literacy, with only 28% of questions being answered correctly on average. Although there are "solutions" out there, none of them necessarily teach you to handle your finances on your own, instead they do it for you. This results in long-term struggles with financial management such as budgeting, saving, investing, and debt management.

My ultimate goal

To provide this demographic with the tools and knowledge needed to make wise financial decisions, which will support their financial stability and ability to bounce back from setbacks in the economy.

Outcome

MoneyWise is a user-friendly app that effectively educates users on financial management while providing personalized tips and insights. The app's intuitive layout and features make it easier for users to track their progress, set goals, and make informed financial decisions, ultimately leading to improved financial literacy and empowerment among users.

1

Methodology

Discover

Research

Key Insights

Market Research

2

Double Diamond Method

I utilized the Double Diamond Design Methodology to explore a broad spectrum of ideas, leveraging both convergent and divergent thinking. This approach guided me through four well-defined stages, enabling me to streamline and organize my design process efficiently.

Define

Persona

User Stories

Task Selection

3

develop

4

Sketching

Wireframes & Prototype

User Testing

deliver

Visual Identity

Marketing

Next Steps

1

Discover

Problem space

Secondary Research

88%

Of millennials feel unprepared to call their own financial shots.

72%

Of adults acknowledge that their lack of financial literacy roots from having no access to finance classes.

43%

Of Gen Z answered basic financial questions incorrectly.

84%

Of Gen Z rely on their parents and family for financial advice.

Young adults recognize the importance of long-term financial planning.

Young adults struggle to find reliable sources of financial education.

Improving financial literacy enhances confidence in making informed financial decisions.

As we navigate our way through the complexity of today’s economy it becomes increasingly evident that millennials and gen z have difficulties understanding and successfully managing their finances.

assumptions

Based on what i’ve learned I can assume..

Young adults would be interested in learning to manage their finances.

Financial literacy leads to better financial outcomes.

Young adults seek financial independence in their financial decision-making.

If individuals actively practice budgeting and make informed financial decisions based on their goals and priorities, they are likely to experience greater financial stability and achieve their long-term financial objectives.

hypothesis

How might we…

Assist Millennials and Gen Z in developing independent financial management skills in order to improve their financial literacy and empower them to navigate their financial futures with confidence and stability?

current mobile solutions

Current mobile financial education apps such as Capital DNA and Ardent Money often lack effectiveness due to outdated content and a lack of personalized guidance, making them less engaging for users accustomed to modern, interactive experiences. Additionally, they provide generic information without considering each user's unique financial situation.

To improve, these apps should update their content to reflect current financial trends and offer personalized guidance tailored to individual users' needs and goals. This approach would make the apps more relevant, engaging, and effective in helping users manage their finances.

research plan

I used the interview method to gather more information regarding millennials and Gen Z’s understanding of managing their finances. I curated 25 open ended questions that will allow me to dive deeper into this topic as well as gaining a better understanding of the issue at hand.

Key insights

Participant Criteria

Between the ages of 18-40

Limited understanding of financial topics.

Has troubles managing their finances

Seeks financial years of age clarity.

What i learned from interviewing

I learned that people want personalized, up-to-date financial guidance in easy-to-use apps. They value engagement, practical advice, trustworthiness, and accessibility in financial education tools.

2

define

persona

Meet Jasmine

experience map

Guiding the Journey

user stories

In order to understand a users basic financial needs, I created 20 user stories. These user stories are essential for guiding the development of features and content within the app. Users were more interested in educational features.

Creating a task flow

TASK SELECTION

3

develop

ui inspo

sketches

wireframes

Version 1

testing plan

As part of the MoneyWise design process, I planned to conduct usability tests with about 10 young adults in order to obtain practical, real-time feedback that can be incorporated to improve the design, in order to provide a more optimal user experience.

testing results

Providing user with lesson progress

Providing user with progress indicator on quiz

Allow user to add a new course on profile

summary

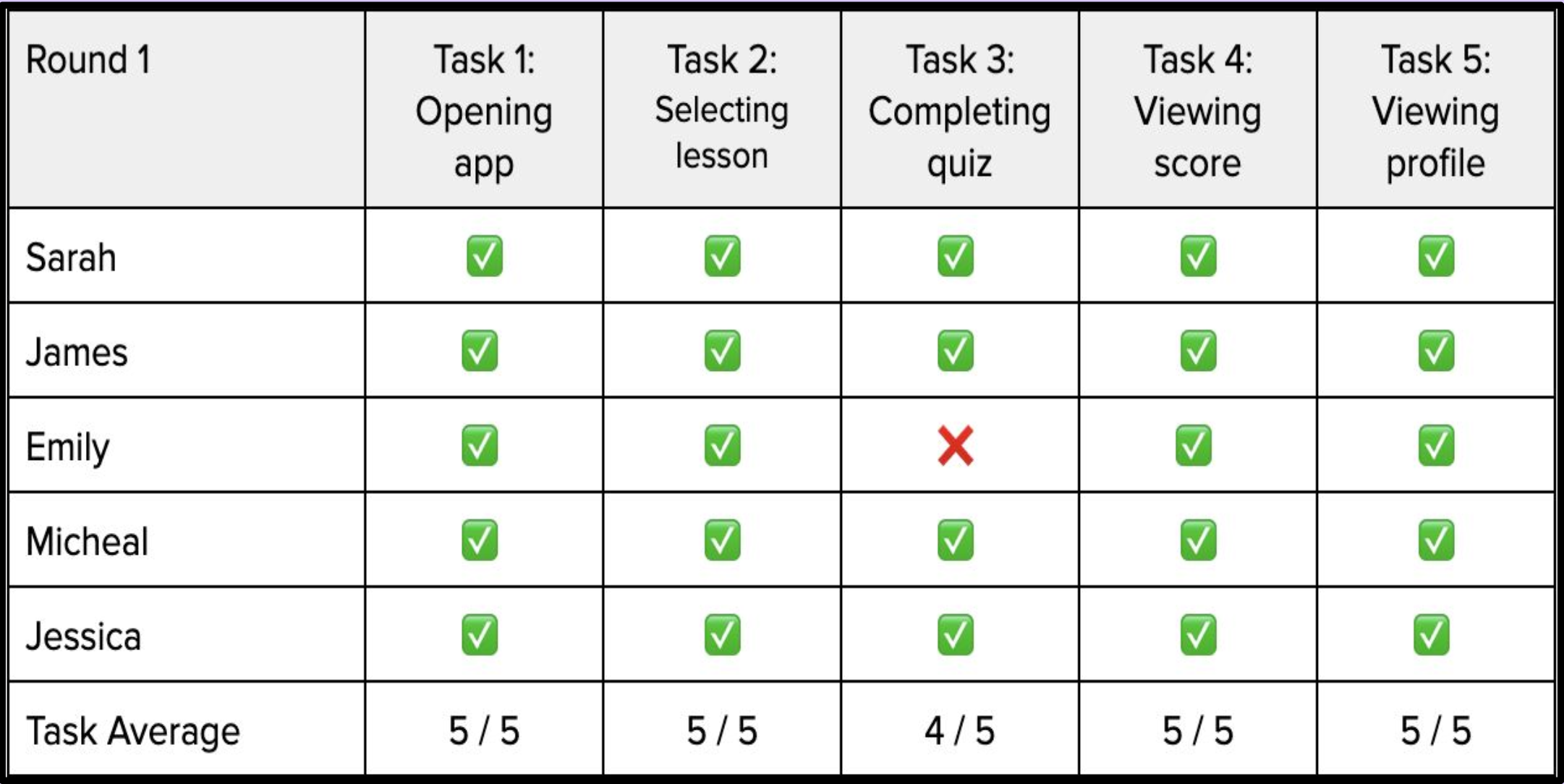

2 rounds of user testing

5 users per testing round

Testing held via zoom

3/13/24 - 3/15/24

tasks

{Task 1: Open the app }

{Task 2: Click on your course}

{Task 3: Start quiz }

{Task 4: Answer questions}

{Task 5: Viewing progress}

Overall, the test results indicated that the application was intuitive and easy to use for most testers. However, several suggestions were given, such as

Provide grades on completed courses

Make it more noticeable when selecting a question

Offer user stats on profile

design prioritization Matrix

wireframe iterations

Before

After

In the prototype, I added a lesson overview and a quiz progress indicator to enhance user navigation and understanding of the learning process. Additionally, I improved the clarity of selecting answers in the quiz section, making it easier for users to interact with the content and track their progress effectively. These changes aim to create a more engaging and intuitive learning experience for users.

Creating a marketing website

Creating a marketing website that is optimized for both mobile and desktop devices is crucial for reaching and engaging with a diverse audience. Mobile optimization ensures that users can access your website seamlessly on their smartphones or tablets, providing a user-friendly experience that caters to on-the-go browsing habits. On the other hand, desktop optimization allows for a more comprehensive and visually rich presentation of your brand, offering a deeper dive into products and services. By prioritizing both mobile and desktop compatibility, I can maximize my website's reach, accessibility, and overall effectiveness in attracting and retaining customers.

Mood Board

Colors & Typography

4

deliver

ACCESSIBILITY TESTING

Ensuring Inclusitivity

identity development

Brand Building

Ui library

Brand Building

hifi prototype

Hifi

marketing

Responsive Design

Content Flow

Wireframes

Future thinking

Looking ahead, being money-wise involves embracing new technological advancements to improve financial literacy and management. This includes using artificial intelligence to provide personalized advice and recommendations tailored to each individual's financial goals and situation. Additionally, incorporating gamification elements into financial education platforms can make learning about money more engaging and enjoyable for users.

A mobile-first approach will continue to be essential, as more people rely on smartphones and tablets for everyday tasks, including managing their finances. This means creating user-friendly and intuitive mobile apps that offer comprehensive financial tools and resources. Moreover, educating users about emerging financial technologies like blockchain and cryptocurrencies will be crucial, as these areas continue to gain prominence in the financial landscape.

Collaborating with employers to develop financial wellness programs for employees is another future-oriented strategy. These programs can provide valuable resources, such as budgeting tools, retirement planning guidance, and debt management solutions, to improve overall financial well-being.

key learnings

Through comprehensive research and user insights, I learned to iterate designs iteratively, incorporating user feedback to enhance usability and effectiveness. Progressing from grayscale wireframes to high-fidelity designs, I realized the importance of aligning visual elements with user needs and aspirations. Brand development was another significant aspect, focusing on crafting a cohesive brand story and value proposition that resonates with users. Overall, the project underscored the value of continuous learning, adaptation, and user-centricity in creating impactful digital products.

next steps

Test my HIFI prototype:

Try out the advanced version of my design to see how well it works and if it meets user needs.

Continue to implement user feedback:

Make changes to the design based on what users say so it becomes even better and more useful.

Iterate and pitch designs to developers:

Keep refining and improving the design while also explaining and presenting it to the people who will build it.

Thank You!